With great pleasure, we will explore the intriguing topic related to Interest Rates in Canada: Outlook for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

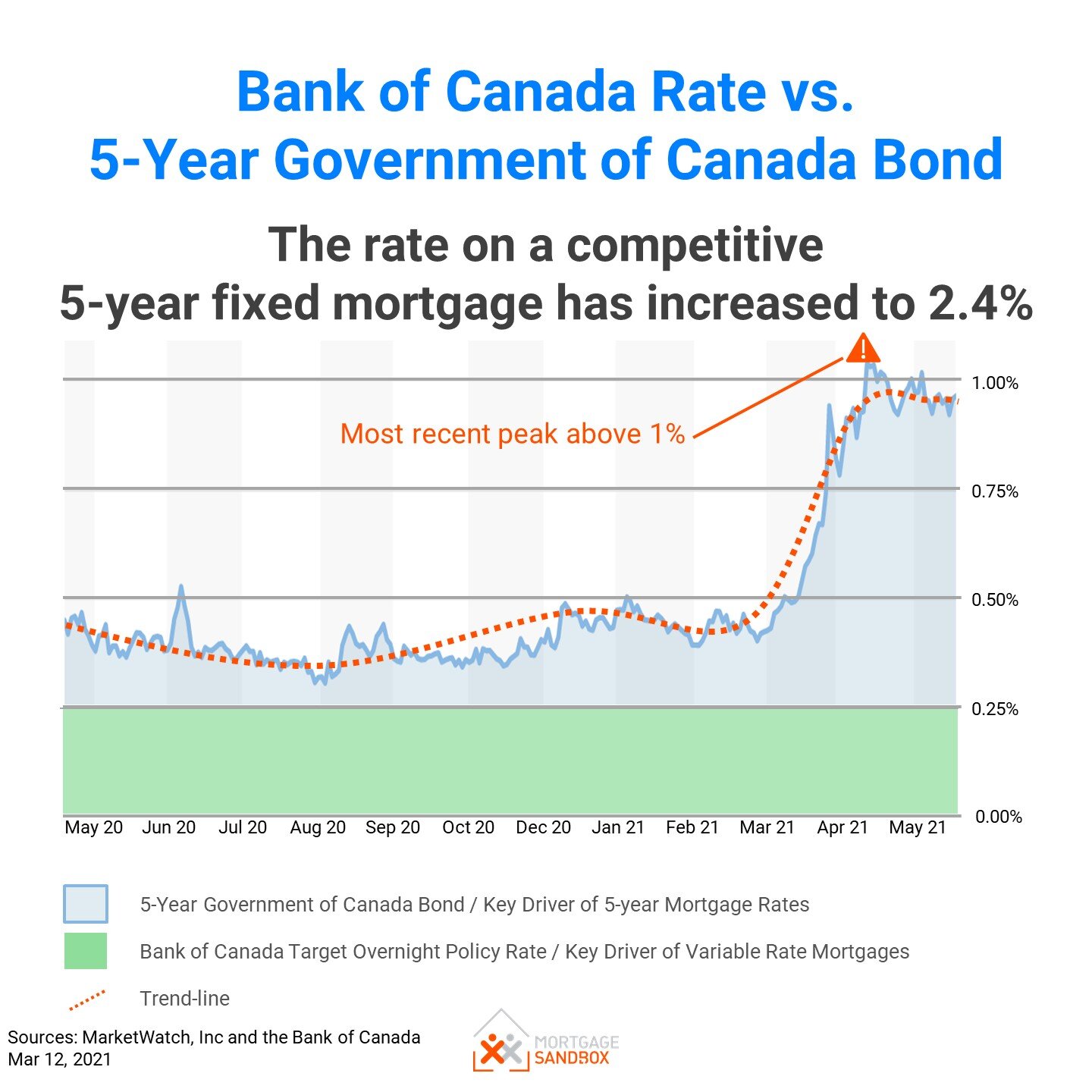

Interest rates are a crucial economic indicator that impact a wide range of financial decisions, from borrowing costs to investment returns. In Canada, the central bank, the Bank of Canada (BoC), sets the target for the overnight rate, which serves as the benchmark for other interest rates in the economy. This article examines the current state of interest rates in Canada and provides an outlook for their trajectory in 2025.

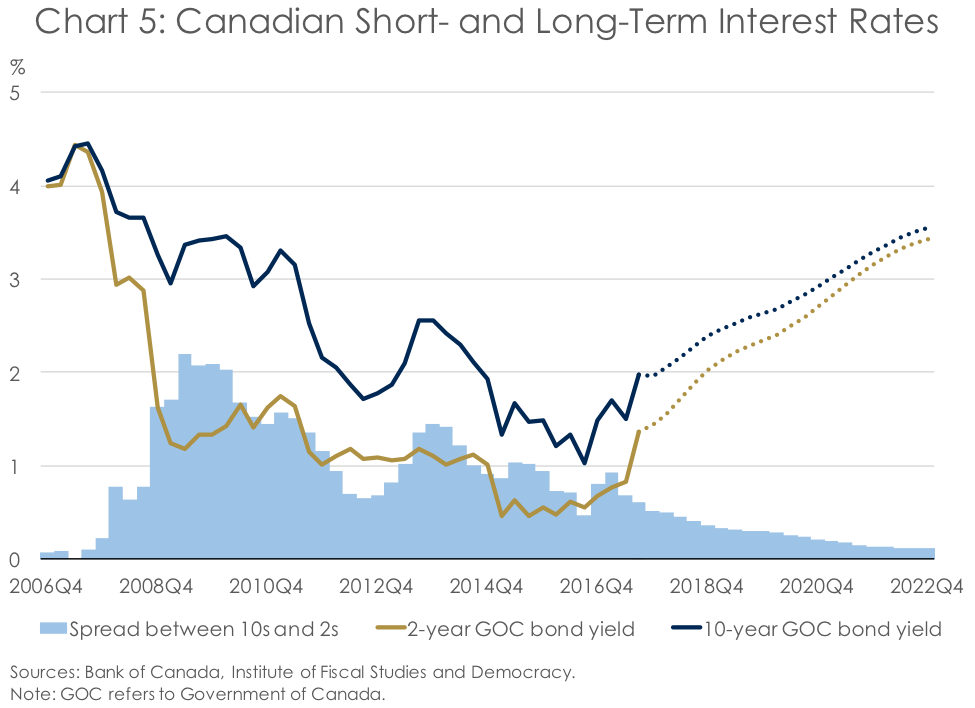

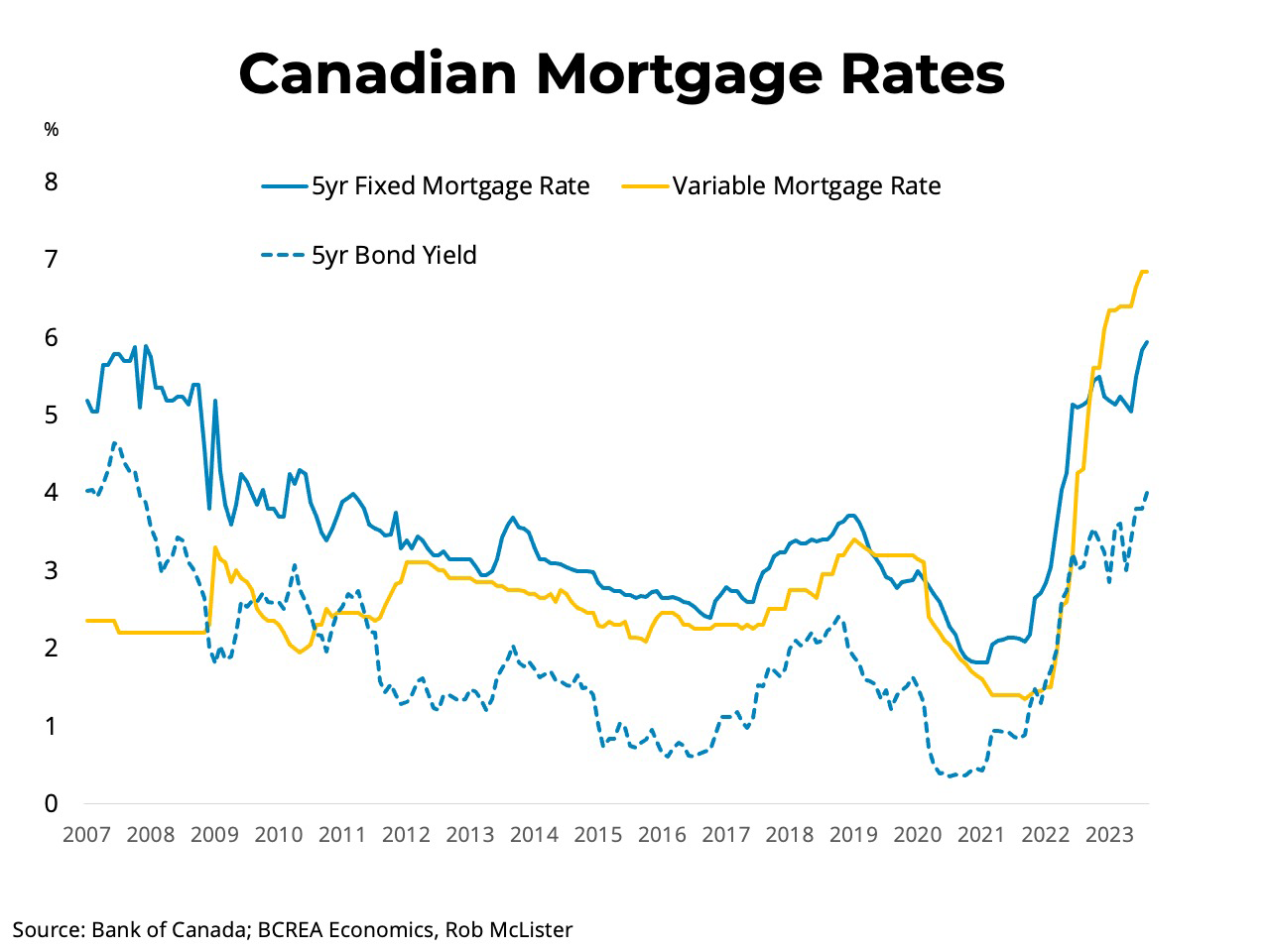

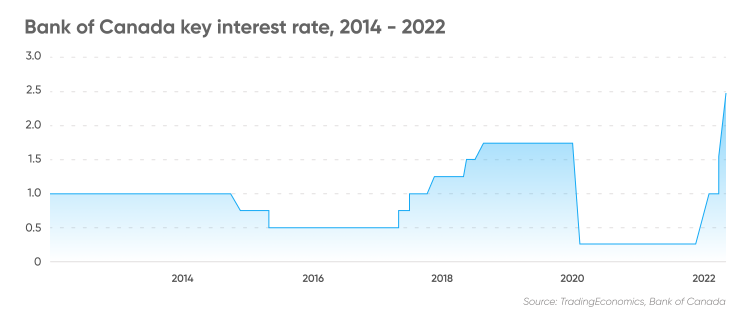

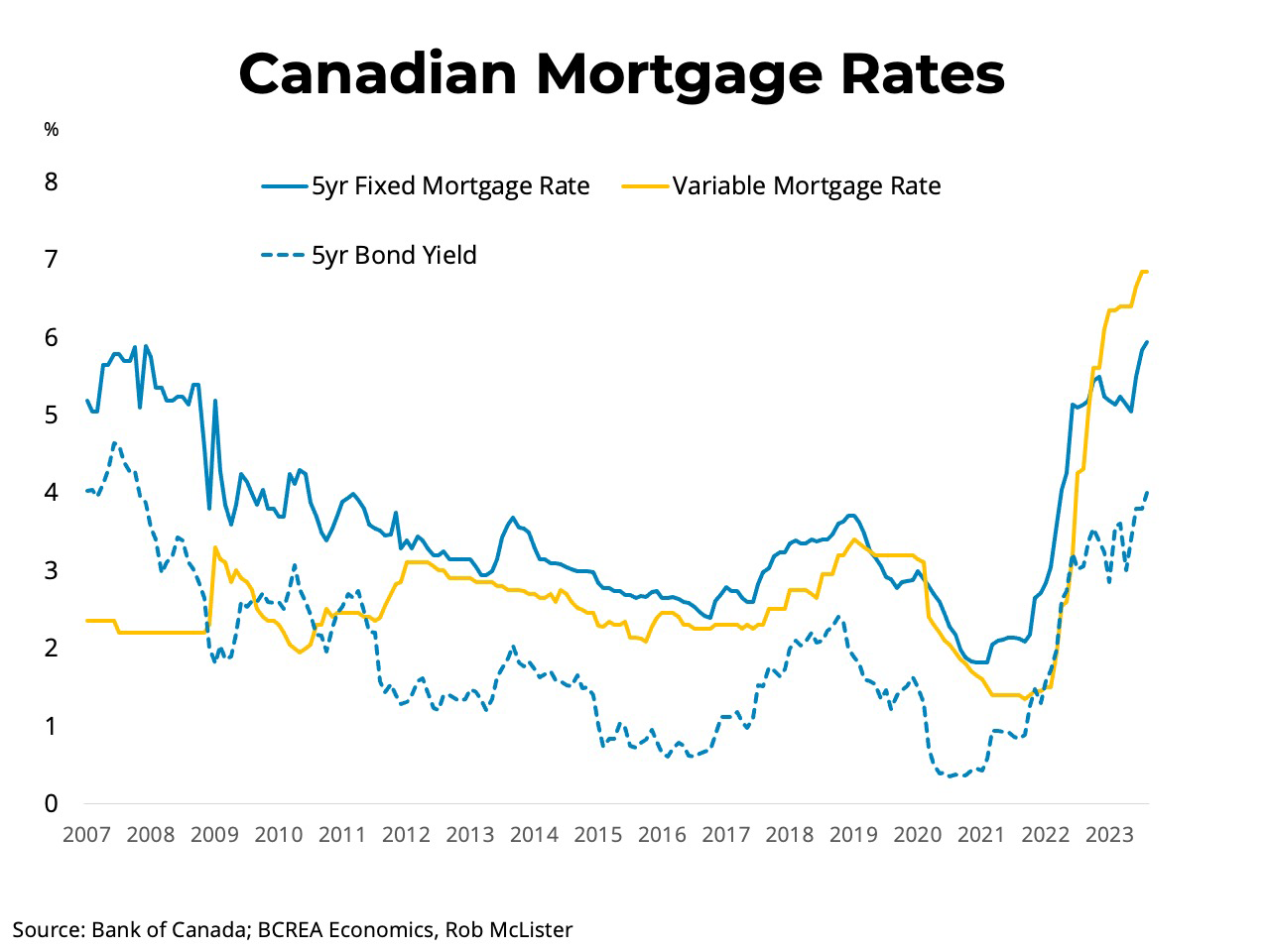

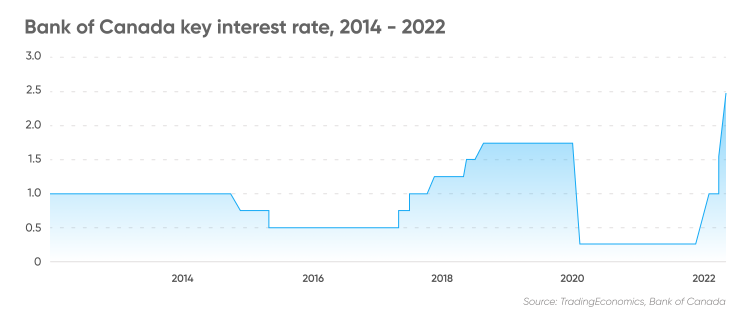

As of December 2025, the BoC’s target for the overnight rate is 4.25%, the highest level since January 2008. This aggressive tightening cycle, which began in March 2025, was implemented to combat persistently high inflation, which has been driven by supply chain disruptions, geopolitical tensions, and strong consumer demand.

Several factors influence the BoC’s decision-making process regarding interest rates, including:

Forecasting interest rates beyond the near term is inherently uncertain, but several factors suggest that rates may remain elevated in 2025.

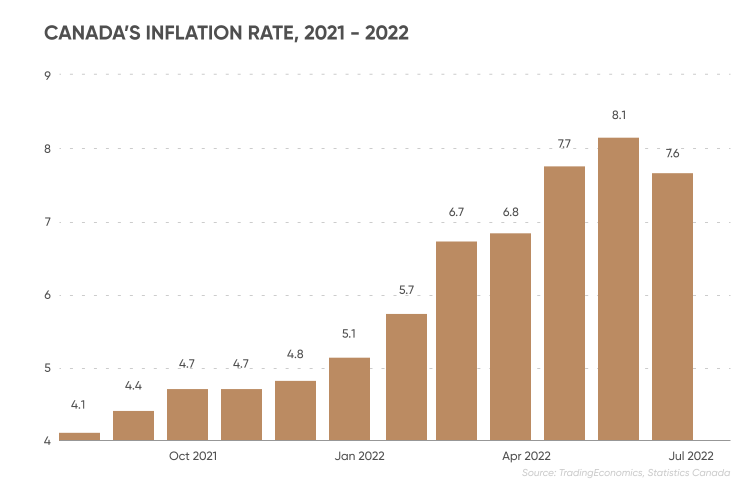

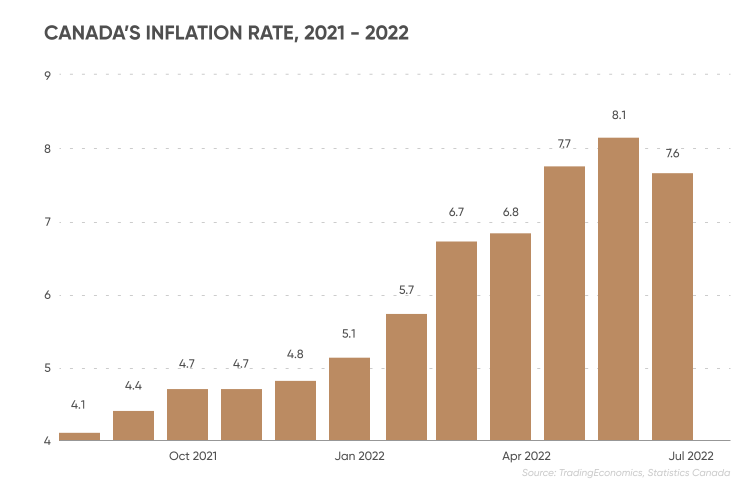

Inflationary Pressures: While inflation is expected to moderate in the coming months, it is likely to remain above the BoC’s target of 2%. Persistent inflationary pressures may necessitate further interest rate hikes.

Economic Growth: The Canadian economy is projected to experience moderate growth in the coming years. However, slowing global growth and geopolitical uncertainties could pose downside risks to the outlook.

.png)

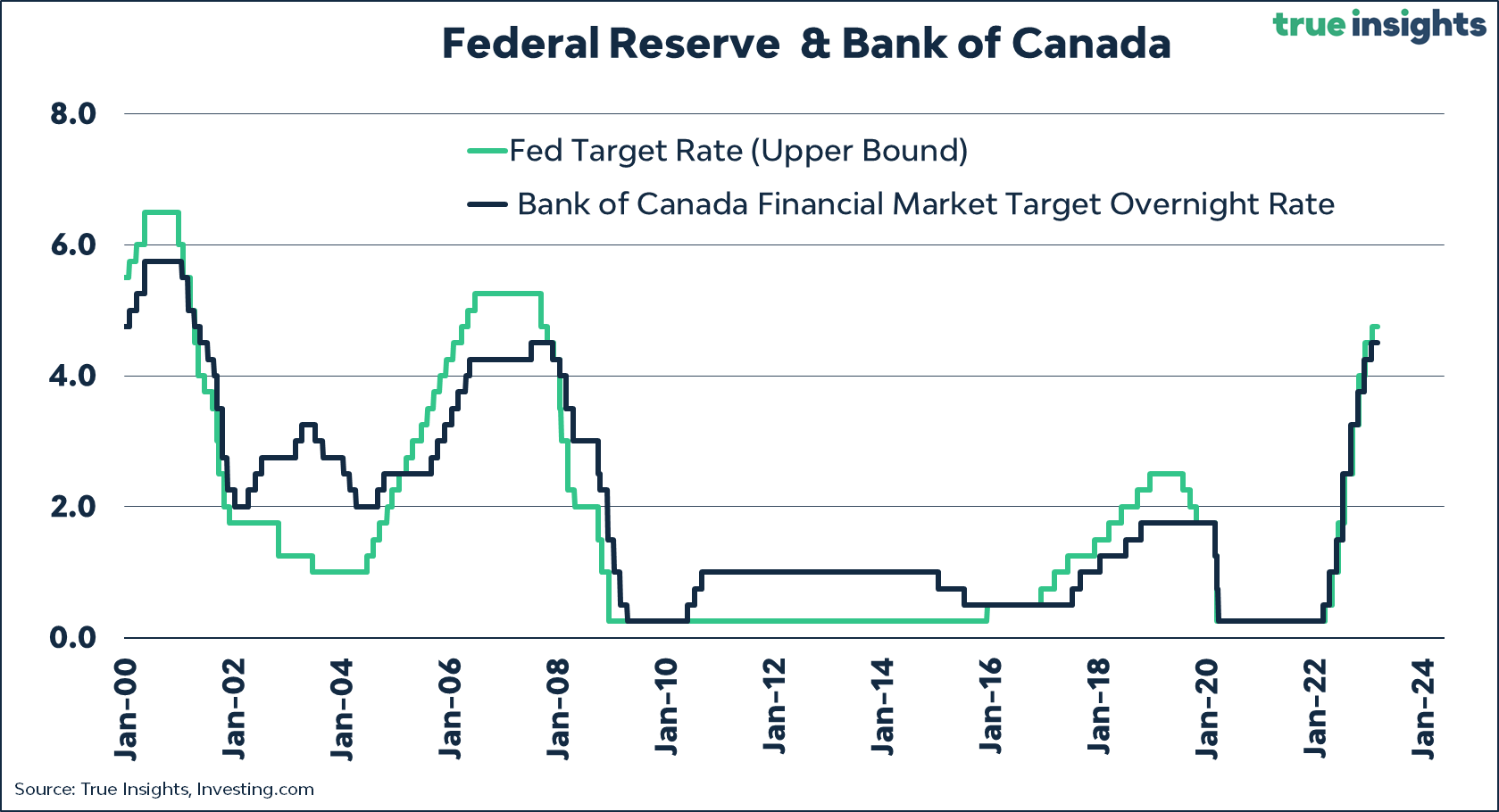

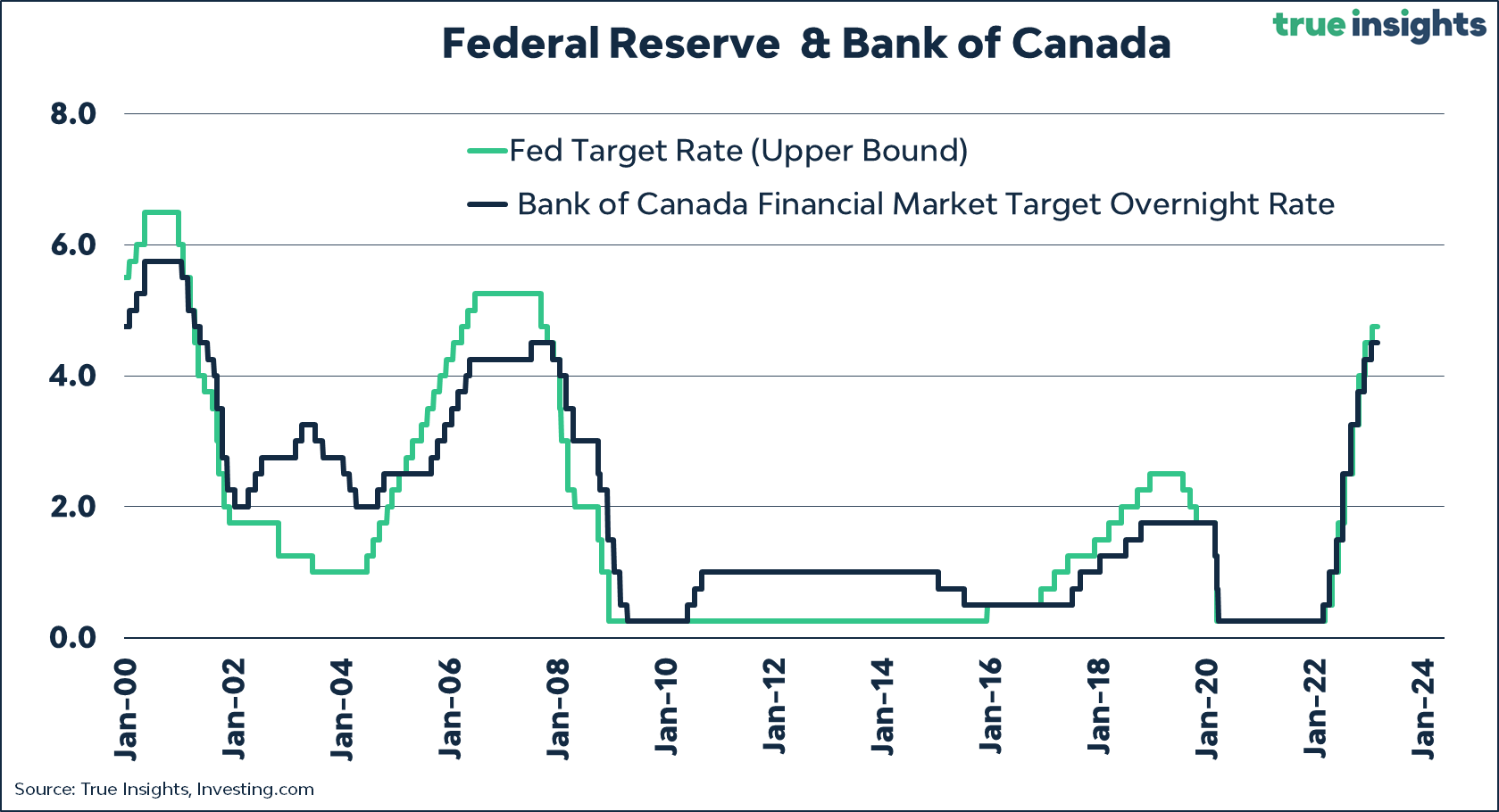

Global Monetary Policy: Central banks around the world are tightening monetary policy to combat inflation. This synchronized tightening could limit the BoC’s ability to lower interest rates in the near future.

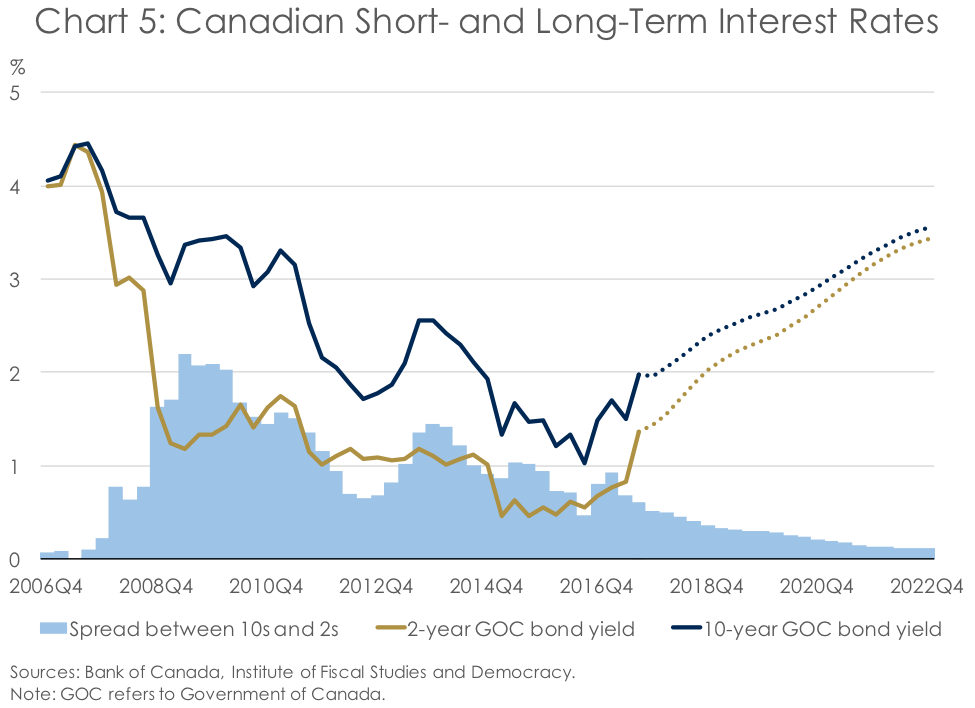

Market Expectations: Financial markets anticipate that the BoC will maintain a relatively high policy rate in 2025. Forward rate agreements, which are contracts that lock in future interest rates, indicate that the overnight rate is expected to remain above 4% throughout the year.

Depending on the evolution of economic and financial conditions, several scenarios could unfold for interest rates in 2025:

The outlook for interest rates in Canada in 2025 remains uncertain but is likely to be influenced by inflationary pressures, economic growth, and global monetary policy. Market expectations suggest that rates will remain elevated throughout the year. Businesses and households should carefully consider the potential implications of higher interest rates on their financial planning and decision-making.

.png)

Thus, we hope this article has provided valuable insights into Interest Rates in Canada: Outlook for 2025. We hope you find this article informative and beneficial. See you in our next article!